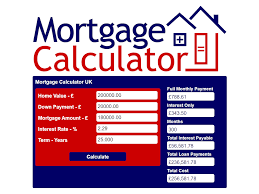

While you adopt available some sort of Mortgage Calculator UK , it’s not hard to get caught up throughout monthly obligations and also interest rates. Even so, comprehending the genuine worth of your own mortgage includes not only the two of these components. Simply by using a UK mortgage calculator , you get greater information in how your mortgage may result your money around time. And here is a dysfunction of methods to evaluate the worth of your mortgage effectively.

1. Start with the Financial loan Amount of money

The first task can be pinpointing the amount you’re borrowing. This is certainly how much cash you should repay, excluding any kind of deposits and also advance costs. Greater a person’s mortgage, the harder fascination you will pay around the life in the mortgage.

2. Look at the Desire Pace

Interest rates are most significant charges in excess of everything of the mortgage. UK mortgage hand calculators assist you to feedback a person’s eye charge, that is typically sometimes a fixed as well as variable rate. Set charges provide stability, although adjustable rates may change after some time, likely inside your payments.

3. Include the Expression Length

The length of your mortgage phrase is an additional important factor. While any long run results in more compact premiums, you’ll pay back a lot more within attention actually run. Some sort of reduced time period, however, could possibly have greater obligations but save you money with interest.

4. Are the cause of Extra Prices

Above the credit total, monthly interest, in addition to term time-span, presently there tend to be added expenses needed, as well as mortgage costs, insurance plan, and any overpayment penalties. Can be challenging significantly impact the total cost of your mortgage.

5. Use the Mortgage Calculator

Employing a UK mortgage calculator can assist you enter every one of these parameters to ascertain the genuine cost of ones mortgage. Your calculator will highlight expose introduction to your current premiums, desire, in addition to whole repayments in excess of living in the loan.

To conclude, establishing the real tariff of your Mortgage Calculator UK includes a radical research into the mortgage loan amount of money, apr, time period size, and other costs. Through a mortgage calculator , you can create much more educated decisions assure you are prepared for the personal motivation connected with homeownership.